INSIGHTS

The $400B Freight Sector is Ripe for Full-Stack Disruption

How owning the assets, operations, and software creates margin, scale, and moat in a fragmented, tech-resistant industry.

Marc El Khoury, Co-Founder & CEO, aifleet

August 4th, 2025

Trucking is the lifeblood of the American economy, moving approximately 72% of the nation's freight. Its efficiency and reliability ripple directly into the prices consumers pay at the shelf. Yet, despite its critical role, trucking remains persistently inefficient, caught in cyclical booms and busts, where everyday Americans, from consumers to truck drivers, bear the economic burden.

The supply chain is "critical infrastructure". Investing in technological innovation within trucking is essential for US Global Resilience (what some in tech call “American Dynamism”). Trucking efficiency is not a “nice to have” for US Global Resilience; it is essential.

Massive Market and Heavy Fragmentation

At the core, the trucking industry's inefficiency today stems from structural fragmentation. Unlike parcel delivery or Less than Truckload (when a trailer is shared among many customers), Full Truckload (TL) (when a trailer is dedicated to moving the goods of a single customer), a $400B+ market in the US, sees no significant improvement in cost structure (cost per loaded mile) as scale increases. Any savings in fuel and equipment (“variable costs”) are outweighed by overhead costs, which rise disproportionately with scale. This structural limitation fosters fragmentation: over 90% of US carriers operate fewer than ten trucks.

The Fragmentation Tax

Today, a trucker drives less than 45% of the time they are allowed to drive. This means that out of an 11-hour drive-time allowance per day, over six hours are “wasted”.

Now imagine the impact of closing the efficiency gap: the US could theoretically move ALL the supply chain’s truckload freight with 50% fewer trucks

The industry has often pointed to “detention”, or waiting at loading docks, as the primary source of inefficiency. It is not. Far from it:

Nearly 65% of waste time (or “dwell”) comes from inefficient load assignment: That is, assigning a suboptimal load to a driver, given their current location, distance from pick-up and delivery, warehouse schedules, appointment availability, and the driver's available “hours of service”. Even in a "fully" autonomous world, all but the last constraint remain.

And this problem does not get better with this level of fragmentation: it gets worse. Every participant (trucking company) who moves the "wrong" load (i.e. a load better suited for another carrier) creates a butterfly impact of inefficiency that ripples across the supply chain.

The trucking industry's inefficiency has a name: "The Driver Shortage." Solve for utilization, and you create an abundance of capacity.

Load optimization today is handled primarily by either drivers themselves or their operations teams. It should instead be handled by AI-based algorithms built to handle the edge cases of the physical world.

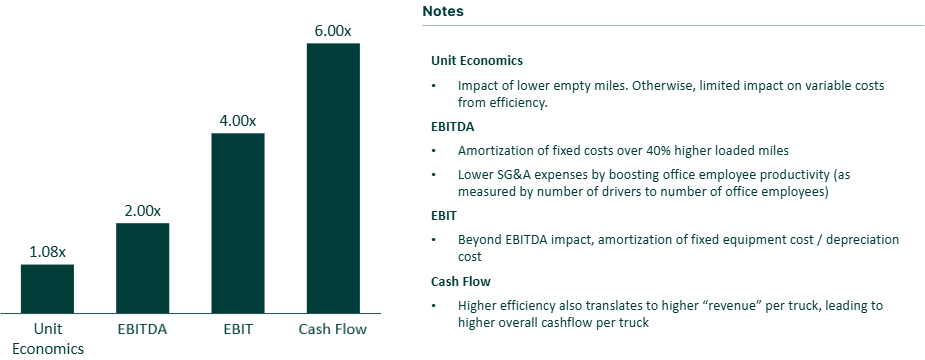

How Efficiency Impacts the Cost Structure of Carriers

Technology, particularly AI-enabled route optimization, represents a substantial opportunity to resolve trucking inefficiencies.

Well-designed, AI-based operations can drive a 50% higher capacity utilization. That does three things:

Amortizes fixed costs (equipment, SG&A) over more loaded miles leading to a lower cost per mile

Improves driver earnings without increasing pay per mile, which boosts retention and reduces churn (a big problem in the industry)

Creates real economies of scale by reducing the need to scale overhead with fleet growth through automation

Here is what AI can do today to the carrier's P&L:

Note that "Unit Economics" are not the target of AI-based efficiencies in the physical world. Cash per truck is.

Why Selling Software Alone Is Insufficient

Provocative truth for the physical world: Software makes suggestions; operators deliver outcomes. Selling optimization software to over 500,000+ carriers sounds attractive, but in practice:

No control, no outcome: A TMS can recommend a plan; only a carrier can execute it. And if "all" edge cases of the physical world are not taken into account (weather, traffic, specific driver behavior, etc.), our instinct will be to make manual adjustments and lose trust.

Integration & inertia tax: Fragmentation makes customer acquisition and deployment costs high. Many fleets treat software as an add‑on, not the operating system. Adoption stalls; benefits never compound.

Incentives misalign. If you don’t control dispatch, planning, appointments, and driver coaching, into one model, the siloes of the existing trucking business model will mean that you cannot consistently capture the value your models identify.

Learning is slow. Without direct ops control, the loop from idea → model → production → measurable outcome takes quarters, not days. Customers may not have this patience.

The Full-Stack Carrier: A Structural Solution

The full-stack carrier emerges as the solution that structurally addresses trucking inefficiencies. By integrating physical assets (trucks, trailers), operational expertise (dispatch and logistics management), and proprietary software into a single unified entity, the full-stack carrier avoids prohibitive change management costs.

In a full-stack model, Operations are built “around” the technology and not the other way around. This requires not only an agile engineering team, but also an agile Operations team.

At a Full-Stack Carrier, “the only constant is change”. The result is a powerful value capture flywheel: tech-savvy operations teams provide high-quality inputs to software development, operations-informed tech teams swiftly generate effective solutions, and rapid deployment of improvements yields immediate and measurable benefits. Early-stage successes fuel continuous improvement and innovation.

No Shortcuts Allowed

There are no shortcuts in building a full-stack carrier. In the focus on building a leading product stack, all other departments must be stood up and perform at least as well as the "average" carrier: from Sales to Operations to Maintenance to Accounting and Collection to Safety and Compliance, the next "fire" can happen anywhere at the company and will divert attention from building the product, which is the real differentiator.

These "fires" are not a distraction, however. They are essential in navigating the journey required to capture the value that only the full-stack carrier can: real economies of scale in an industry where heavy fragmentation has persisted, and 1% market share has long been the growth ceiling.

The Payoff

Realizing the potential of full-stack trucking operations meets key Supply Chain Resilience Goals:

Reduced Costs for Consumers: Increased efficiency lowers total cost per mile, alleviating inflationary pressures on consumer goods.

Higher Driver Earnings: Improved productivity per truck boosts driver income, enhancing job stability and attractiveness.

Environmental Impact: Reduced empty miles and asset dwell decrease diesel consumption and associated emissions, advancing sustainability goals.

The full-stack carrier represents not only the practical solution to longstanding trucking inefficiencies but also embodies a critical pillar of the American Dynamism vision, laying the groundwork for a more resilient, productive, and prosperous American supply chain and economy.